Are you tired of living paycheck to paycheck, wondering where all your hard-earned money went? It’s time to take control of your finances with the power of budgeting. In this guide, we’ll explore budgeting 101 and share simple yet effective strategies to help you manage your money wisely.

Understanding the Basics of Budgeting

At its core, budgeting is about creating a plan for your money. It involves tracking your income, expenses, and savings to ensure that you’re living within your means and working towards your financial goals. By allocating your resources wisely, you can prioritize your spending, reduce financial stress, and build a brighter financial future.

Start with the Basics: Income and Expenses

The first step in creating a budget is to identify your sources of income. This includes not only your primary salary but also any additional income streams such as side gigs, freelance work, or rental properties. Once you have a clear picture of your income, it’s time to track your expenses.

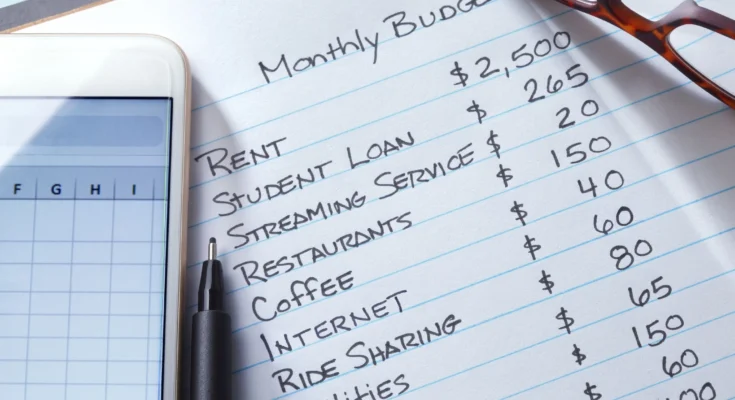

Begin by categorizing your expenses into fixed and variable categories. Fixed expenses are recurring costs that remain relatively constant each month, such as rent or mortgage payments, utilities, insurance premiums, and loan repayments. Variable expenses, on the other hand, fluctuate from month to month and encompass discretionary spending like dining out, entertainment, and shopping.

Adopt Simple Budgeting Strategies

Now that you’ve identified your income and expenses, it’s time to adopt simple budgeting strategies to take control of your money:

- Envelope System: Allocate cash for different spending categories and keep them in labeled envelopes. Once the cash in an envelope is gone, you’re done spending in that category for the month.

- 50/30/20 Rule: Allocate 50% of your income to needs (such as housing and utilities), 30% to wants (such as dining out and entertainment), and 20% to savings and debt repayment.

- Zero-Based Budgeting: Give every dollar a job by allocating your entire income towards expenses, savings, or debt repayment until you reach zero.

Leverage Technology to Simplify Budgeting

In today’s digital age, there’s an array of budgeting tools and apps available to simplify the budgeting process. From Mint to YNAB (You Need A Budget) to Personal Capital, find a tool that suits your preferences and helps you track your income and expenses effortlessly. These tools offer insights into your spending patterns, provide alerts for upcoming bills, and help you stay on track with your financial goals.

Conclusion

In conclusion, budgeting doesn’t have to be complicated. By understanding the basics of budgeting, tracking your income and expenses, and adopting simple budgeting strategies, you can take control of your money and build a brighter financial future. So, if you’re ready to stop living paycheck to paycheck and start working towards your financial goals, start budgeting today!